Are you interested to know how many jobs are available in property-casualty insurers? Property-casualty insurers are integral to the insurance sector, safeguarding property and peoples belongings in the event of misfortune. In this article, you will learn everything you need to know about the property-casualty insurance industry and the many job opportunities available.

According to the Bureau of Labor Statistics (BLS), there are over 628,000 jobs available in property-casualty insurers, in the United States. This figure includes a number of different job roles that will will discuss later on in this article.

- What are Property-Casualty Insurers?

- How Many People are Employed in the Insurance Industry?

- Is Property-Casualty Insurers a Good Career Path?

- Best Paying Jobs in Property-Casualty Insurers

- How Big is the P&C Insurance Industry?

- 3 Largest Property and Casualty Insurers in the US?

- More Property and Casualty Insurance Companies

- Final Thoughts

What are Property-Casualty Insurers?

Property-casualty insurers protect against various types of risks associated with property and liability. Individuals, enterprises, and governments all purchase this kind of insurance. Some common examples of these policies include home insurance, automobile coverage, commercial building insurance, and liability protection. Coverage may include expenses caused by theft, fires, weather and damages caused by the policyholder.

How Many People are Employed in the Insurance Industry?

According to the Bureau of Labor Statistics, there are 2.8 million workers employed in the insurance industry, in the United States. The insurance industry is constantly changing and evolving, so the number of people employed in the industry will fluctuate over time. The quantity of jobs offered in the insurance industry is vast and varies depending on the size of the company and its geographic location.

Is Property-Casualty Insurers a Good Career Path?

A career in property-casualty insurance can be a good choice for some people. It can offer a variety of job opportunities, competitive salaries, and the potential for advancement. Some of the roles within property-casualty insurance include underwriting, claims adjusting, sales, and management. These roles can require different levels of education and experience, and can offer different levels of responsibility and earning potential.

However, as with any career, it is important to research and consider whether a career in property-casualty insurance aligns with your interests, skills, and goals. It’s also important to investigate the job market in your area and the specific requirements for the role you’re interested in. Additionally, you may want to consider the insurance industry’s overall trends. It’s a good idea to speak with professionals currently working in the field and to learn more about the day-to-day responsibilities and long-term career prospects in property-casualty insurance.

Best Paying Jobs in Property-Casualty Insurers

Some of the best paying jobs in property-casualty insurers include the following:

Actuary

An actuary is a profession in the property-casualty insurance field that specializes in using mathematical and statistical techniques to gauge the potential cost and likelihood of future events, such as illness, natural disasters, and accidents. Insurance providers utilize these assessments to establish policy pricing and generate new products. Furthermore, actuaries assess past claim and loss data to detect trends and discern useful information that may inform the business decisions of an insurance firm. The Bureau of Labor Statistics reports that the average salary for actuaries is $105,900 annually.

Underwriter

Underwriters assess risk in insuring a certain individual or property. They investigate the possibility of a loss, set the terms and conditions of an insurance policy, and determine the corresponding premium. They assess insurance applicants and decide whether or not to approve them. Individuals with a background in finance, business, economics, or a related field typically serve as underwriters. According to the BLS, the average salary for underwriters is $113,169 yearly.

Claims Adjuster

A claims adjuster is an expert in property and liability insurance claims. They are responsible for assessing the degree of an insurance provider’s liability and mediating settlements with claimants. They evaluate the claim, policy, and evidence while employing knowledge of the policy contract and insurance regulations. This helps them to make decisions regarding liability and determine the claim amount. In some cases, adjusters may draw on the aid of engineers, investigators, and medical professionals to collect more data. The yearly average salary of claims adjusters is $107,000.

Risk Manager

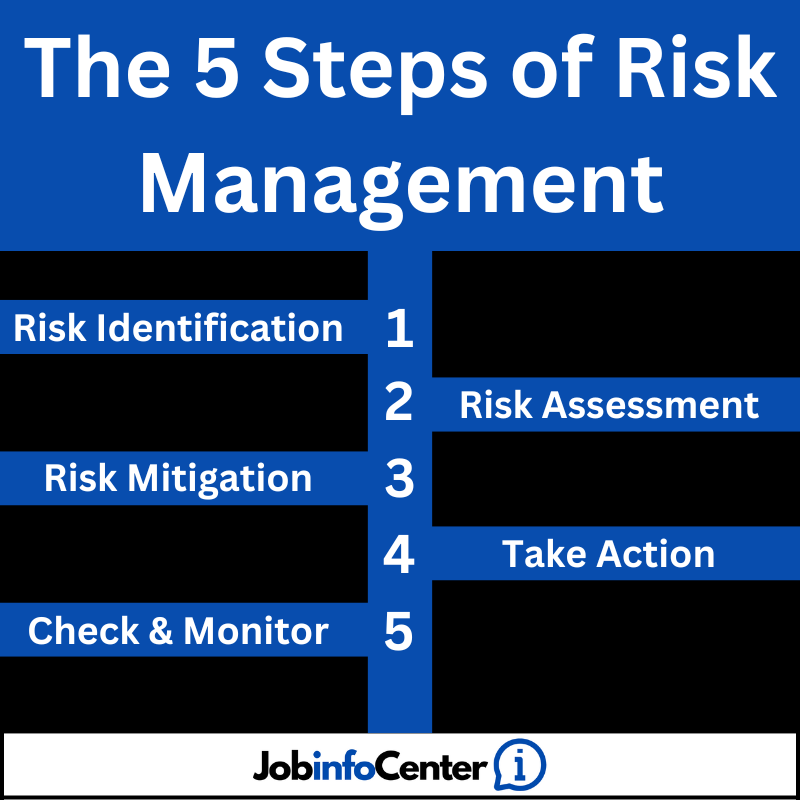

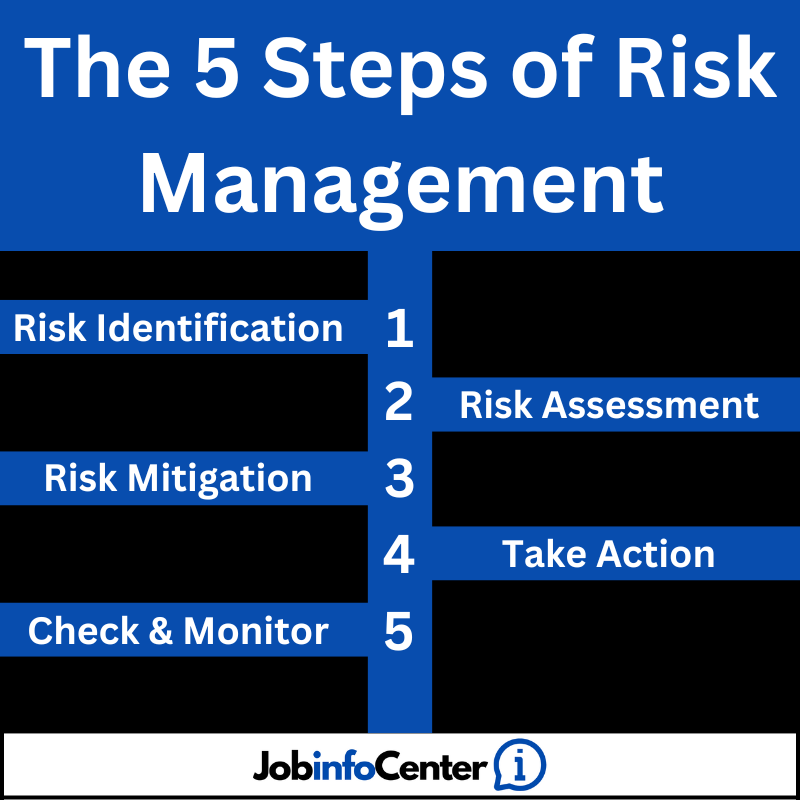

Risk managers are responsible for identifying, appraising, and assigning importance to any potential risk to an organization. They execute strategies to lessen and manage these risks. They also help organizations understand and handle the threats they are exposed to. This involves the study of data and determining the effectiveness of current procedures and policies. Risk managers may cooperate with internal departments and external entities to carry out fresh measures to reduce risk. The average salary for a risk manager is $122,000 annually.

Loss Control Consultant

Loss control consultants consult with insurance customers to identify and evaluate possible risks. They then build strategies to avert or reduce the impact of these risks. They inspect sites in person, analyze safety protocols, and recommend necessary changes. Loss control consultants may even aid in developing emergency response plans and conduct training sessions for personnel. In the US, the average salary for a loss control consultant is $105,000 a year.

Insurance Broker

Insurance brokers operate as intermediaries between insurance companies and policyholders. They locate the appropriate coverage for their customers at an affordable rate by partnering with multiple insurance providers. They also assist clients in understanding and reviewing the insurance process, including filing claims. On average, insurance brokers in the US make $88,216 annually.

Data Analysts

Data analysts in the property-casualty insurance industry apply data to identify patterns, trends, and insights. They then utilize the data to improve the decision-making process. Data from claims, policyholders, and market research is collected, processed, and studied to identify risks and opportunities. The work that data analysts carry out supports underwriting, pricing, and marketing decisions. The average salary for data analysts is $81,000 a year.

How Big is the P&C Insurance Industry?

The Property and Casualty (P&C) insurance industry is a vast and dynamic sector. The P&C industry plays a crucial role in protecting individuals and businesses from financial loss in the event of unexpected events. These events include accidents, natural disasters, and other unforeseen circumstances. The industry is composed of a wide range of companies, including large multinational corporations and smaller, specialized firms.

In terms of size, the P&C insurance industry is significant, with a global market size of over $1 trillion. The industry is projected to grow at a steady pace in the coming years. This will be driven by factors such as population growth, urbanization, and increased demand for insurance products and services. The P&C insurance industry in the United States is one of the largest in the world, with a market size of over $500 billion.

The P&C insurance industry also employs a large number of people globally. Millions of people are working in roles such as underwriting, claims adjusting, sales, and management. Additionally, the industry plays a significant role in the economy, generating revenue and providing jobs for many people.

3 Largest Property and Casualty Insurers in the US?

1: State Farm

As the largest property and casualty insurer in the United States, with a market share of 8.89% and total direct written premiums of $70.3 billion in 2021, State Farm provides a variety of insurance products and services. These include auto, home, life, health, business, and farm insurance, as well as banking and investment options. Moreover, being a mutual company, State Farm is owned by its policyholders and managed by its network of agents. Their mission is to help people cope with risks in daily life, restore what is lost, and fulfil their dreams.

2: Berkshire Hathaway

Berkshire Hathaway holds the second-largest market share at 6.42% and direct written premiums at $50.7 billion in the same sector. Berkshire Hathaway is a well-known and respected player in the property-casualty insurance industry. Led by CEO Warren Buffet, the company is known for its conservative underwriting practices and its focus on long-term growth. Berkshire Hathaway operates a number of insurance subsidiaries, including GEICO, General Re, and National Indemnity. These companies specialize in various lines of insurance such as auto, homeowners, and commercial insurance.

The company is also known for its strong financial position, with an AA+ credit rating from Standard & Poor’s. This solid financial footing, combined with the company’s well-established brand and reputation, has made Berkshire Hathaway a popular choice among consumers and businesses looking for insurance protection.

3: Progressive Insurance Company

Progressive Insurance Company is a well-known and respected player in the property-casualty insurance industry. The company is known for its innovative approach to insurance and its use of technology to make it easier for customers to purchase and manage their insurance policies. Progressive is one of the largest auto insurance providers in the United States. It owns $47.7 billion in direct written premiums and 6.04% of the market share.

Progressive is also known for its customer-friendly approach, such as its “Name Your Price” tool. This tool allows customers to input their desired monthly premium and then shows them a list of coverage options that fit within that budget. This feature allows customers to be more in control of their insurance costs, and make more informed decisions.

More Property and Casualty Insurance Companies

AIG

American International Group, Inc. (AIG) is a leading global property-casualty insurance company that provides a wide range of insurance products and services to customers around the world. Founded in 1919, AIG has a long history of providing protection for individuals and businesses. It has become one of the most recognizable and respected insurance companies in the world. The company offers a wide range of insurance products and services, including commercial and personal lines of insurance. AIG is also known for its innovative risk management solutions, which help customers to minimize their exposure to potential losses.

Allstate

Allstate Corporation is one of the largest property-casualty insurance companies in the United States. They offer a wide range of insurance products and services to individuals, families, and businesses. Founded in 1931, the company has a long history of providing protection and peace of mind to its customers. Allstate is known for its “You’re In Good Hands” slogan and its commitment to helping customers protect what matters most to them.

The company offers a variety of insurance products, including auto, home, and life insurance, as well as financial services and investment products. Allstate also has a strong focus on innovation. The company is constantly working to develop new and improved products and services to meet the changing needs of its customers. Additionally, the company has a strong community involvement. Allstate foundation and agency owners volunteer their time and resources to improve the communities in which they live and work.

Liberty Mutual

Liberty Mutual is a global property-casualty insurance company that has been in operation for over 100 years. Founded in 1912, the company provides a wide range of insurance products and services to individuals, families, and businesses. Liberty Mutual is known for its commitment to customer service and for offering flexible and customizable insurance solutions to meet the unique needs of its policyholders. The company offers a variety of insurance products, as well as specialty lines of insurance such as workers’ compensation and commercial property insurance.

Additionally, Liberty Mutual has a strong commitment to sustainability and corporate responsibility. They have implemented several initiatives to reduce their environmental impact and to support the communities where they operate. The company also has a strong focus on employee development and culture. This is reflected in their employee retention rate, making it a great place to work.

Chubb

Chubb is a global property-casualty insurance company that is known for its specialized insurance products and services for high-net-worth individuals and businesses. Founded in 1882, Chubb has a long history of providing customized and comprehensive insurance solutions to its customers. The company’s insurance products include personal and commercial lines, including property and casualty coverage for businesses of all sizes. Chubb is also known for its specialized insurance products such as aerospace, fine art and jewelry, and cyber risk insurance.

The company has a reputation for providing exceptional customer service and claims handling. They have a team of highly skilled underwriters who are able to tailor coverage to meet the unique needs of its policyholders. In addition, Chubb has a strong commitment to corporate social responsibility, and actively works to support the communities where it operates through various initiatives and programs.

Travelers

The Travelers Group is a global property-casualty insurance company that is known for its wide range of insurance products and services for individuals and businesses. Founded in 1864, the company has a long history of providing protection and peace of mind to its customers. The Travelers Group offers a variety of insurance products such as workers’ compensation, commercial auto and general liability insurance. The company is also known for its innovative and comprehensive risk management solutions, which help its customers to minimize their exposure to potential losses.

Final Thoughts

Jobs in the property-casualty insurance industry are diverse and varied, and provide a range of opportunities for professionals to make a meaningful impact in the lives of individuals and businesses. From underwriting and claims handling to sales and marketing, there is something for everyone in the industry. The industry is constantly evolving and adapting to changing market conditions, and this means that job opportunities are always arising.

Additionally, many property-casualty insurance companies have a strong commitment to employee development and culture, making it an attractive career choice for those looking to grow and advance in their field. The industry is also a great place to work in terms of diversity, as it is open to people of different backgrounds and experience.

Overall, the property-casualty insurance industry provides a challenging and rewarding career path for those looking to make a difference in the lives of others and build a successful career.