Life insurance is a crucial aspect of financial planning, providing peace of mind and security for individuals and families. The industry is constantly growing and evolving, offering a wide range of job opportunities. In this article, we will take a closer look at how many jobs are available in life insurance. We will also explore the different roles and responsibilities of each position and the qualifications required. Whether you’re just starting out in your career or looking for a change, this article will give you a better understanding of the opportunities available in life insurance.

According to the Bureau of Labor Statistics (BLS), there are over 911,400 jobs available in life insurance, in the United States.

- What is Life Insurance?

- How Does Life Insurance Work?

- What Does Life Insurance Cover?

- What Does Life Insurance Not Cover?

- What are the Different Types of Life Insurance?

- How Much Does Life Insurance Cost?

- Is Life Insurance a Good Career Path?

- Requirements for a Career in Life Insurance

- 10 Best Paying Jobs in Life Insurance

- How Many People are Employed in the Insurance Industry?

- 3 Largest Life Insurance Companies in the US

- Conclusion

What is Life Insurance?

Life insurance is a form of insurance that pays out money after the insured person dies. The policyholder pays a regular premium to the insurer. In the event of their death, the insurer pays a death benefit to the beneficiary named in the policy. Life insurance is primarily used to provide financial security for the policyholder’s loved ones in case of death. It can cover funeral costs, outstanding debts, and lost income for the policyholder’s family.

How Does Life Insurance Work?

Life insurance creates a contract between the policyholder and the insurer. When the policyholder purchases a life insurance policy, they select a coverage amount, also known as the death benefit. This is the amount of money the insurer will pay to the designated beneficiaries in the event of the policyholder’s death. The policyholder also selects the premium payment frequency, which can be monthly, quarterly, semi-annually, or annually.

The policyholder designates a beneficiary or beneficiaries who will receive the death benefit in the event of the policyholder’s death. The beneficiary can be anyone the policyholder chooses, such as a spouse, child, or another family member.

The beneficiary or beneficiaries will submit a claim to the insurer when the policyholder dies. The insurer will verify the death and that the policy was in force at the time of death. The insurance company will then pay the death benefit to the beneficiary or beneficiaries. Different insurers have different ways of calculating premiums and setting up payment schedules. For example, some companies may offer a lump sum payment at the time of purchase, or an individual might pay in installments over their lifetime.

What Does Life Insurance Cover?

Life insurance can be used to cover a wide range of expenses, including:

Funeral Costs

If you die, your family will have to pay a large and unexpected expense. The funeral cost can be huge, and life insurance can help reduce the financial burden of losing a loved one.

Debts

Life insurance is an affordable form of debt coverage. As with any form of debt, if an individual dies without leaving sufficient funds to his or her creditors, these individuals will likely be forced to declare bankruptcy. If a policyholder dies without the necessary funds, their family may suffer severe financial hardship.

Lost Income

If you die and your family is forced to take care of your children or elderly relatives, medical bills can quickly mount up. Life insurance can help you cover these expenses as long as your dependents are not dependents on another policy or contract. If you are insured through another agreement, like a joint life insurance policy with a spouse, your dependents will not be covered through the other contract.

Long-Term Needs

The death benefit can be used for other long-term expenses, such as providing for a special-needs child or ensuring that the policyholder’s business can continue to operate after their death.

Mortgage Payments

Life insurance can provide financial security for the policyholder’s mortgage. While the mortgage lender can foreclose on the policyholder’s house, the insurance money will be transferred to the beneficiary so that payments on their mortgage can continue.

Other Expenses

Life insurance can cover different types of expenses, such as medical costs after a severe illness or outstanding loans.

What Does Life Insurance Not Cover?

Life insurance typically does not cover certain types of deaths or events. These can include:

Suicide

Most life insurance policies have a suicide clause, which means that the death benefit will not be paid if the policyholder dies due to suicide within a specified period after the policy is issued (usually two years).

Illegal Activities

The death benefit will not be paid if the policyholder dies due to their participation in an unlawful activity.

Natural Causes

Life insurance policies typically exclude death from natural causes such as disease or illness.

Pre-Existing Conditions

Life insurance policies may exclude coverage for death caused by pre-existing medical conditions before the policy was purchased.

War and Terrorism

Some policies specifically exclude coverage for death caused by war or acts of terrorism.

Self-Inflicted Injuries

Certain policies exclude deaths from self-inflicted wounds such as drug overdoses.

Hazardous Activities

Some policies may exclude deaths from participating in activities such as skydiving, bungee jumping, or scuba diving.

It’s important to note that these exclusions vary by policy and by the insurer, so it’s essential to review the terms and conditions of a policy carefully before purchasing it.

What are the Different Types of Life Insurance?

There are several different types of life insurance, each with its own unique features and benefits.

Some of the most common types of life insurance include:

Term Life Insurance

Term life insurance is the most common type of life insurance policy. It provides a death benefit for a pre-determined period. The amount paid out depends on the term selected, from 10 to 30 years.

Universal Life Insurance

Universal life insurance is another common type. Universal life insurance provides a death benefit for the term selected. The amount paid out depends on the insured person’s age and the total cost of their premiums.

Limited-Term Life Insurance

Limited-term life insurance is an alternative to universal life insurance. This policy provides a fixed death benefit that increases with each passing year based on the policyholder’s age and cost. The policy expires at the end of the term, and premiums are no longer required.

Whole Life Insurance

Whole life insurance combines life insurance and an investment account. This type of policy provides a death benefit for life, but its value may fluctuate with changes in the market.

Burial/Final Expense Insurance

This type of life insurance is designed to cover funeral and burial expenses. It typically does not require a medical exam and can be a good option for individuals who may not qualify for other types of life insurance.

How Much Does Life Insurance Cost?

The cost of the policy depends on many different insurance factors, like age and health status. Suppose an individual is healthy and has no additional risk factors (like smoking). In this case, that person will likely be eligible for a lower premium rate than someone with more risk factors and medical problems. On average, life insurance costs between $15 and $40 per month, but this range can vary widely. The price can increase to up to $100 or more per month in certain situations, such as when one has a pre-existing medical condition or smokes heavily.

Is Life Insurance a Good Career Path?

Yes. Life insurance is a good career path as it offers the opportunity to impact lives positively and build relationships with those around you.

Here are a few reasons why a career in life insurance may be a good choice for you:

Job Security

The insurance industry is a stable and growing field, with a consistent demand for life insurance agents and other professionals.

Growth Opportunities

The life insurance industry offers a variety of career paths, including sales, underwriting, claims, and management. There are opportunities for advancement and career growth for those willing to work hard and develop their skills.

Helping Others

Life insurance professionals have the opportunity to help people protect their families and financial futures. They can provide peace of mind to their clients by ensuring that they have the coverage they need to protect against unexpected events.

High Earning Potential

A life insurance agents salary can range depending on experience and location. Top life insurance agents have high earning potential, with many earning six-figure incomes.

Flexibility

Many life insurance companies offer flexible work arrangements, such as working remotely or on a part-time basis. This can benefit those looking for a career with an excellent work-life balance and be wouuld perfect if you have children or other family obligations.

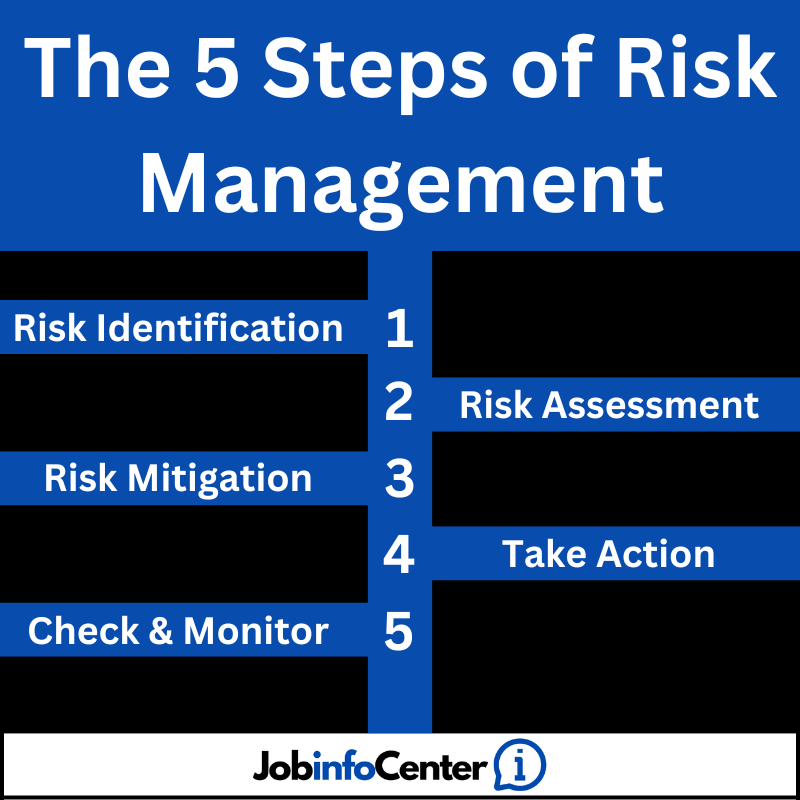

Requirements for a Career in Life Insurance

The qualifications required for a career in life insurance vary depending on the specific job, but some common requirements include:

Education

Many life insurance jobs require a bachelor’s degree, typically in a field such as business, mathematics or finance. Some advanced positions, such as an actuary, may require a master’s degree.

Industry Certifications

Some life insurance jobs, such as underwriting and claims management, require industry certifications. These certifications can demonstrate expertise in a specific area and can be earned through professional organizations such as the American Academy of Actuaries.

Analytical Skills

Many life insurance jobs require strong analytical skills, including the ability to understand and interpret data, perform calculations, and make informed decisions based on data.

Communication Skills

Good communication skills are important in many life insurance jobs. Life insurance professionals must be able to explain complex information to clients and other stakeholders.

Problem-Solving Skills

Life insurance professionals must be able to analyze complex information, identify potential problems, and develop effective solutions to address those problems.

Customer Service Skills

Many life insurance jobs, such as customer service representatives, require strong customer service skills. They need the ability to handle customer inquiries and complaints professionally and effectively.

A career in life insurance can be challenging and will not be the right fit for everyone. It requires a strong work ethic, good communication skills, and building and maintaining relationships with clients. It also requires a strong understanding of the products offered by the company and the ability to navigate and comply with state and federal regulations. Additionally, a career in life insurance can be demanding, with extended hours and the need to meet sales quotas. It’s also worth noting that the insurance industry in the United States is becoming increasingly competitive. Therefore, it requires a lot of effort, dedication, and persistence to succeed.

10 Best Paying Jobs in Life Insurance

If you are planning on starting a career in life insurance, you might be wondering which jobs pay the most.

Here are the 10 best paying jobs in life insurance:

1. Actuary

In the life insurance industry, actuaries play a crucial role in helping companies design, price, and manage life insurance. They use mathematical and statistical methods to study and analyze financial risk and uncertainty. The average salary for an actuary working in life insurance is $118,366 per year.

2. Risk Modeling Manager

A Risk Modeling Manager in the life insurance industry is responsible for overseeing the development and implementation of risk models used by the company to assess and manage financial risk associated with life insurance products. The salary for a risk modeling manager ranges from $128,107 to $190,000 per year.

3. Life Insurance Agent

A life insurance agent is a sales professional who specializes in selling life insurance policies to individuals and families. A life insurance agent can earn an average salary of $83,672 per year.

4. Claims Director

A Life Insurance Claims Director is a senior manager responsible for overseeing the administration and processing of life insurance claims within a life insurance company. The salary for a claims director ranges from $150,130 to $199,757 annually.

5. Customer Service Representative

Customer service representative’s assist customers with questions and concerns regarding their insurance policies and payments. The average salary for a customer service representative is $46,216 per year.

6. Insurance Manager

Being an insurance manager involves managing the day-to-day operations of an insurance company. The salary for an insurance manager ranges from $66,138 to $150,000 per year.

7. Underwriter

A life insurance underwriter evaluates and assesses the risk of insuring an individual or a group. The primary responsibility of a life insurance underwriter is to determine the likelihood that a life insurance policy holder will file a claim. They then also determine the premium rate that should be charged based on that risk. The average salary for an underwriter in this field is $77,957 annually.

8. Senior Financial Analyst

A Senior Financial Analyst provides financial analysis and support to the life insurance company. They are responsible for monitoring and analyzing financial performance and identifying trends and opportunities for improvement. The salary for a senior financial analyst ranges from $75,000 to $150,000 per year.

9. Casualty Underwriter

A casualty underwriter specializes in underwriting non-life or casualty insurance policies. Casualty insurance policies include coverage for various types of liability and property insurance, such as liability insurance for businesses, workers’ compensation insurance, and automobile insurance. The salary for a casualty underwriter ranges from $87,500 to $121,000 per year.

10. Claims Adjusters

A life insurance claims adjuster investigates, evaluates, and settles claims for death benefits made under life insurance policies The salary for a claims adjuster ranges from $54,000 to $90,000 per year.

How Many People are Employed in the Insurance Industry?

According to the Bureau of Labor Statistics, there are approximately 2.8 million people employed in the insurance industry in the United States. This includes positions in roles such as underwriters, insurance sales agents, claims adjusters, and actuaries. It also includes people employed in different types of insurance like life, health, and property and casualty insurance.

3 Largest Life Insurance Companies in the US

1. Northwestern Mutual

Northwestern Mutual is a mutual life insurance company based in Milwaukee, Wisconsin. The company is one of the largest life insurance providers in the United States, with a market share of 11.5% as of 2021. The company offers a wide range of life insurance products, including term life, whole life, universal life insurance, annuities, long-term care insurance, and disability income insurance. In addition to its life insurance products, Northwestern Mutual is also known for its financial planning and investment management services. It is considered one of the US’s most reputable and robust financial institutions.

2. New York Life

New York Life Insurance Company is a highly respected and well-established insurer that has been serving the needs of customers for over 170 years. Founded in 1845, the company has a long history of providing a wide range of life insurance products to customers throughout the United States. The company has a strong commitment to its clients, offering expert guidance and support to help them make informed decisions about their financial futures. New York Life is among the oldest and most prominent life insurance companies in the United States, with over 8.3% market share. The company offers a number of life insurance products, including term life, whole life, and universal life insurance.

3. MassMutual

MassMutual Life Insurance Company is a leading provider of life insurance and financial services with a long history of serving customers since 1851. MassMutual offers a wide range of insurance products, including term life insurance, whole life insurance, and universal life insurance. The company is also known for its innovative financial services, including annuities, long-term care insurance, and disability insurance. MassMutual has a strong commitment to its customers, offering expert guidance and support to help them make informed decisions about their financial goals and security. The company is one of the largest life insurance providers in the USA, with a market share of 7.1%.

Conclusion

The life insurance industry offers a wide range of exciting and challenging careers from underwriting and actuarial science to claims administration and customer service. Whether you are interested in using your analytical skills to assess risk, or you have a passion for helping people and families, there is a life insurance job that is right for you. With opportunities for advancement and growth, life insurance careers offer stability, security, and the chance to make a positive impact on people’s lives. Whether you are just starting your career or looking for a change, the life insurance industry is an excellent place to build a fulfilling and rewarding career.