Life insurance agents play a crucial role in helping individuals and families plan for their financial future. As a life insurance agent, you can help clients secure their loved one’s financial well-being in unexpected circumstances. But how much do life insurance agents make?

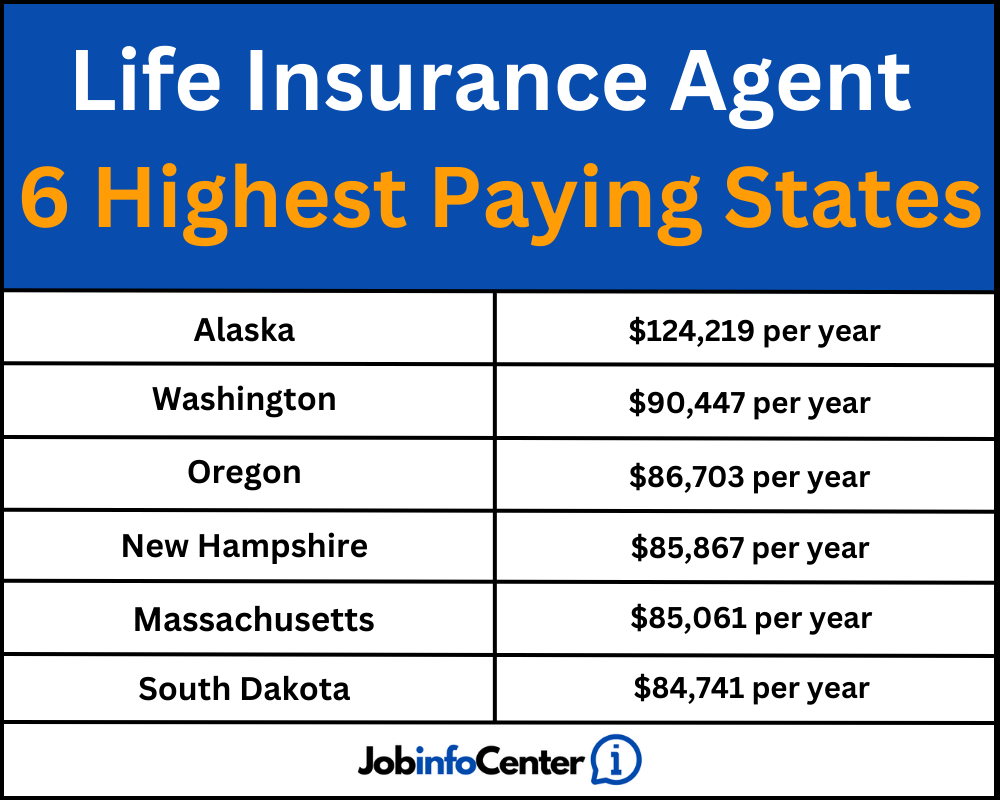

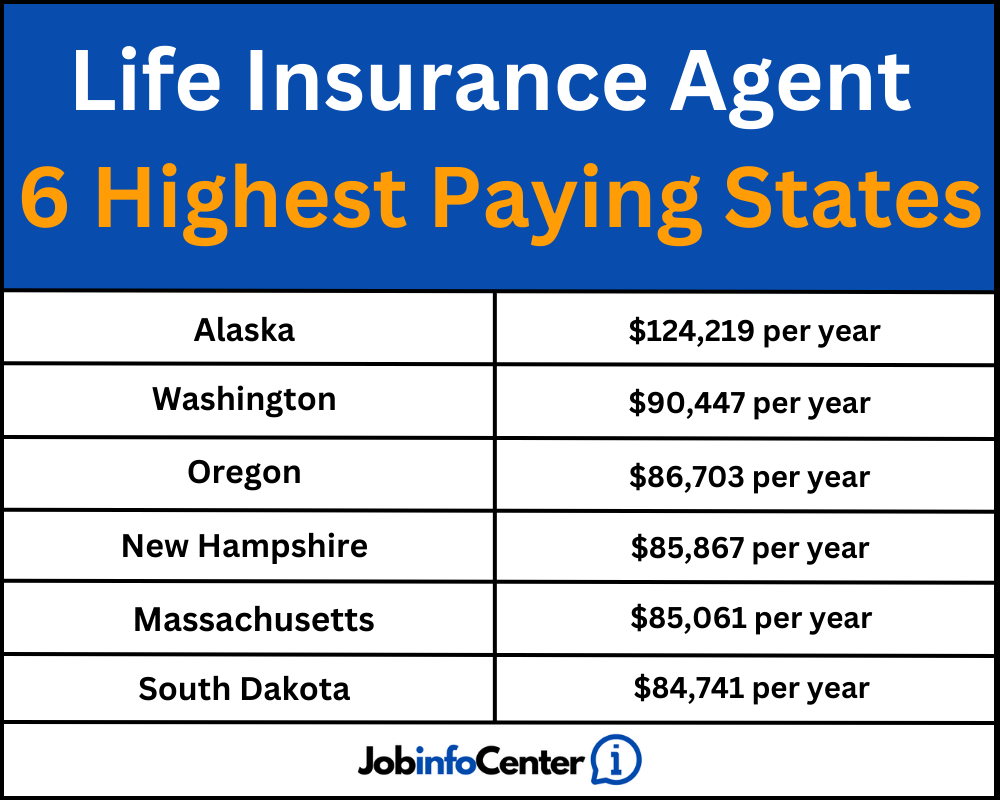

Life insurance agents often make salaries ranging from $30,000 to $100,000 a year, depending on their experience, the size of their book of business, and their commission structure. Highly successful agents can even make more than $100,000 annually. This can vary greatly based on experience, company, and location factors.

In this article, we will take a look at the best paying life insurance jobs, aswell as exploring some of the key factors that influence their salaries.

- Best-paying jobs in life insurance

- Is selling life insurance a good job?

- How to become a life insurance agent?

- How to get a life insurance license?

- How to sell life insurance?

- How long does it take to get an insurance license?

- How do insurance agents get paid?

- Is it hard to make money as a life insurance agent?

- Which type of insurance agent makes the most money?

- How to become an independent insurance agent?

- Conclusion

Best-paying jobs in life insurance

Some of the highest-paying jobs in the life insurance industry are:

Actuary

An actuary uses mathematics and statistics to assess and manage financial risk in life insurance policies, including the risk of death. This job involves working with clients to create customized insurance plans and determine appropriate premium rates. Actuaries typically earn between $70,000-$180,000 a year.

Insurance Underwriter

An underwriter is responsible for assessing the risk associated with issuing a life insurance policy, determining the premium rate, and deciding whether or not to approve the policy. Underwriters typically earn between $50,000-$90,000 a year.

Financial Planner

A financial planner helps individuals and families set financial goals and plan for their future. This job requires an understanding life insurance policies, investments, taxes, and other financial instruments. Financial planners typically earn between $50,000-$130,000 a year.

Sales Director/Manager

A sales director or manager is responsible for leading a sales team to meet and exceed sales targets and managing relationships with key clients. The salary for this position can range from $70,000-$175,000 a year.

Insurance Agent

An insurance agent sells life insurance policies and other insurance products to individuals and businesses. The role requires strong customer service and sales skills and a deep understanding of life insurance policies. Insurance agents typically earn between $40,000-$100,000 a year.

Is selling life insurance a good job?

Selling life insurance is a great career choice for those with the right skills and attitude. It offers competitive salaries, flexible hours, and the potential to help people secure their financial future. In addition, life insurance agents can build relationships with clients and benefit from their continued business. With hard work and dedication, life insurance agents can make a great living helping others.

Here are some pros and cons to consider when deciding if selling life insurance is a good job:

Pros

- High earning potential: Life insurance sales can be a high-paying job, with many agents earning a good income through commissions and bonuses.

- Flexibility: Life insurance agents can often work flexible hours and can work from home, making it a good choice for those who value work-life balance.

- Growth opportunities: Many life insurance companies offer training and development opportunities, and successful agents may be able to advance into leadership positions.

- Helping people: For many agents, the satisfaction of helping clients protect their families and financial futures is a major benefit of the job.

Cons

- Uncertainty: Commission-based jobs can be unpredictable, and life insurance sales can be seasonal, with some months being busier than others.

- Rejection: Life insurance sales can be challenging, as agents may face frequent rejections from potential clients.

- Compliance: Life insurance agents must be familiar with complex regulations and follow ethical sales practices to avoid legal and reputational risks.

- Long hours: Building a successful life insurance sales career often requires a significant investment of time, with many agents working long hours and weekends to build their client base.

Selling life insurance can be a good job for motivated individuals who have strong sales skills and are comfortable with uncertainty and potential rejection. However, it may not be a good fit for everyone.

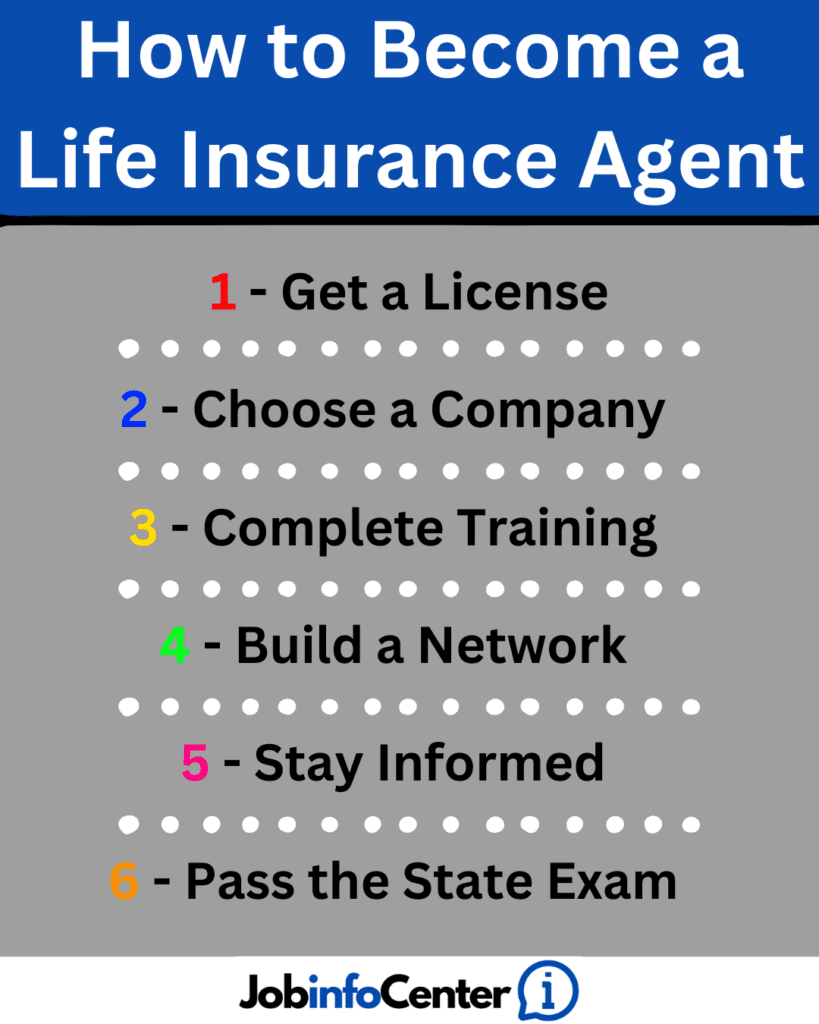

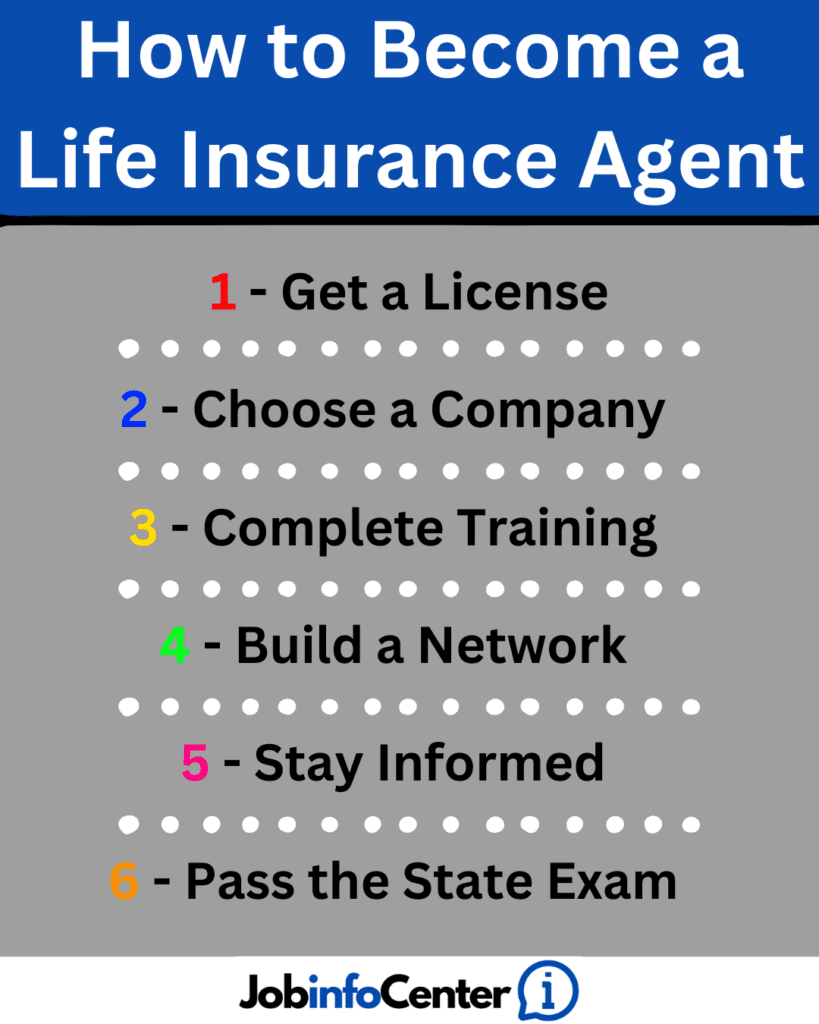

How to become a life insurance agent?

Becoming a life insurance agent typically requires the following steps:

1. Meet licensing requirements

To sell life insurance, you must be licensed by your state’s insurance department. Requirements for licensure vary by state but generally include passing a pre-licensing exam and a background check.

2. Choose a life insurance company to work for

Life insurance agents can be independent or work for a specific company. Independent agents have the flexibility to work with multiple insurance companies, while company-sponsored agents typically have more training and support resources available. You should regularly check job sites to find available jobs in life insurance, as they can be snapped up quickly.

3. Complete training

Most life insurance companies train new agents to help them understand their products and sales techniques. This can include both classroom-style training and hands-on, on-the-job training.

4. Build a network of contacts

Life insurance sales often involve building and maintaining client relationships. Agents should develop a strong network of contacts, including friends, family members, and other professionals, to help generate leads and grow their client base.

5. Stay informed

Life insurance products and regulations can change over time, so agents need to stay informed and continue their education. Many insurance companies provide ongoing training and development opportunities to help agents stay up-to-date.

6. Pass the state licensing exam

After completing the necessary pre-licensing education and training, you will need to pass the state licensing exam to become a licensed life insurance agent.

How to get a life insurance license?

To become a life insurance agent, you must obtain a license from the state in which you wish to practice.

In most states, getting a life insurance license typically requires the following steps:

1. Meet eligibility requirements

In most states, you must be at least 18 years old and have a high school diploma or equivalent.

2. Complete pre-licensing education

Most states require that you complete a certain number of hours of pre-licensing education, which is typically offered by insurance schools, colleges, or trade associations.

3. Pass a licensing exam

After completing your pre-licensing education, you will need to pass a licensing exam. The exam is designed to test your knowledge of insurance regulations and products.

4. Apply for a license

Once you have passed the licensing exam, you will need to apply for a license through your state’s insurance department. You may need to provide proof of your education, background check results, and other information.

5. Meet continuing education requirements

Most states require life insurance agents to complete a certain number of continuing education credits each year to maintain their license.

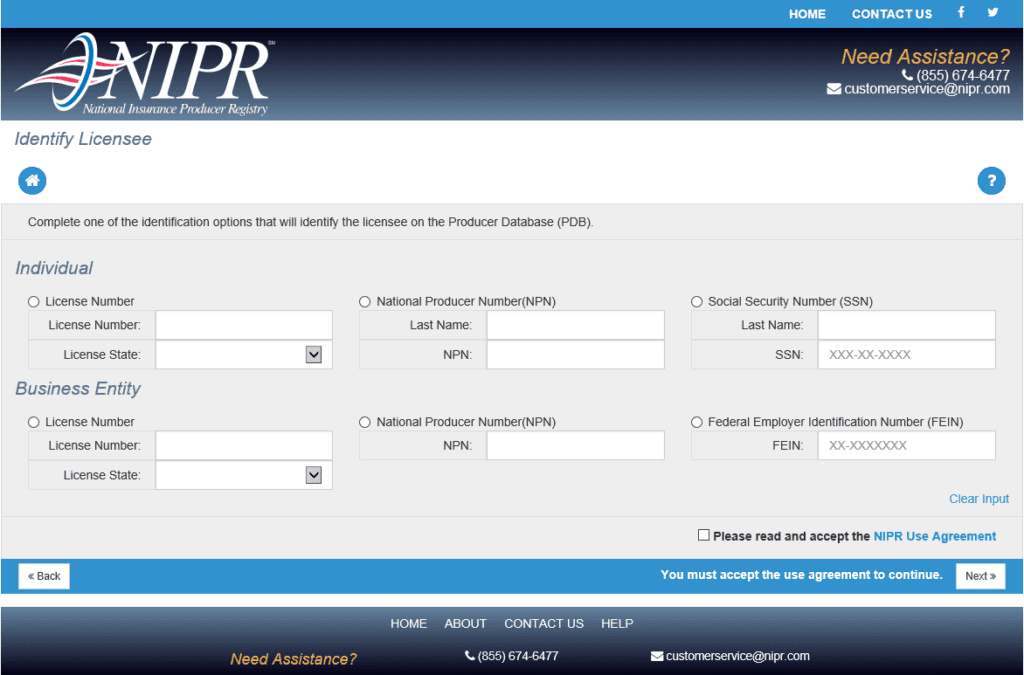

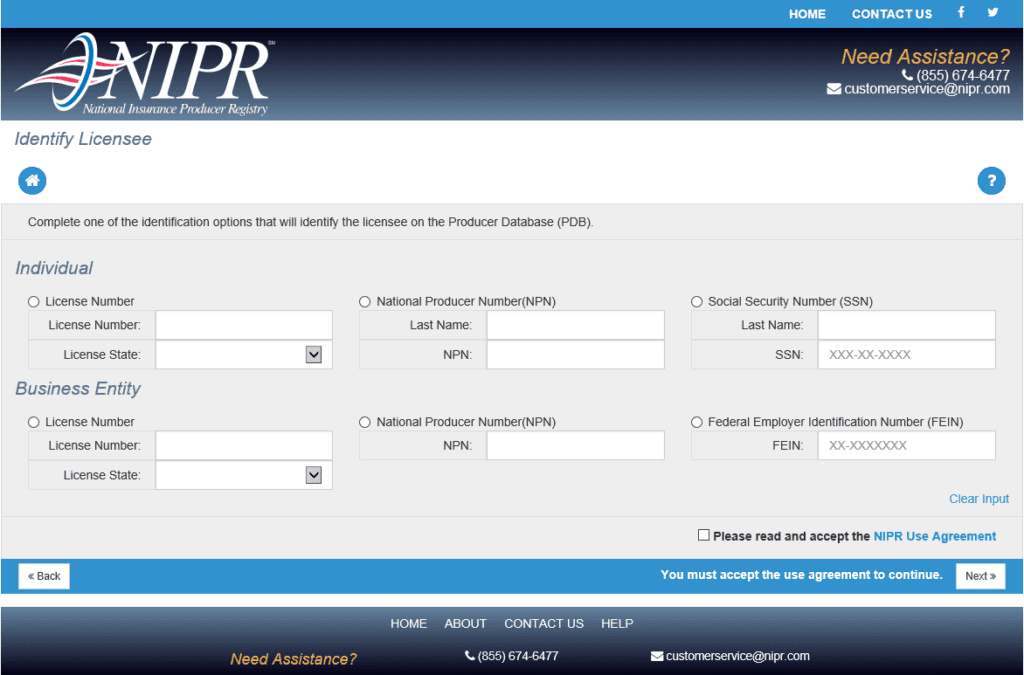

6. Register with the National Insurance Producer Registry (NIPR)

The NIPR is a database that tracks the licenses and appointments of insurance agents and brokers.

How to sell life insurance?

Selling life insurance involves several steps, including:

Building knowledge

Familiarize yourself with the life insurance products you will be selling, including the features and benefits of each, as well as the target market for each product.

Developing a sales pitch

Craft a clear, compelling sales pitch that highlights the importance of life insurance and the benefits of the products you are selling.

Building a network

Develop a network of contacts, including friends, family members, and other professionals, to help generate leads and grow your client base.

Qualifying leads

When a potential client expresses interest, use a questionnaire or other tool to determine their needs and fit for the products you offer.

Presenting the product

Schedule a meeting with the potential client and present the life insurance product(s) that best meet their needs. Be prepared to answer questions and address any concerns they may have.

Closing the sale

Once you have presented the product and addressed any questions, close the sale by asking for the policyholder’s commitment to purchase.

Following up

Keep in touch with your clients after the sale to ensure their satisfaction and to identify opportunities for additional sales.

How long does it take to get an insurance license?

The amount of time it takes to get an insurance license varies from state to state, but typically it takes between four and six weeks. The process usually involves completing pre-licensing education, passing a licensing exam, submitting an application for a license, and registering with the NIPR. You may be able to complete the process faster or slower, depending on how quickly you can study for and pass the licensing exam. Additionally, some states may require additional steps, such as a background check or an interview.

How do insurance agents get paid?

The primary way insurance agents get paid is through commissions. Commissions are typically paid out periodically, such as monthly or quarterly, and are based on the number of policies an agent has sold. Additionally, some agents may receive bonuses or other incentives for meeting certain goals. Insurance agents may also receive additional payments, such as renewals and/or fees for services such as claims processing. Certain companies may also offer additional benefits such as health insurance and pension services.

Is it hard to make money as a life insurance agent?

The question of whether it is hard to make money as a life insurance agent depends on several factors, including the individual’s sales skills, experience, and market conditions in their area. Life insurance agents typically earn their income through commission, which means that their earnings are directly tied to the number of policies they sell.

Competition in the life insurance market can be intense, as agents may face competition from other agents and from direct-to-consumer insurance products. Building a client base takes time and effort, and generating new leads and closing sales can be challenging. Market conditions, such as interest rates and consumer sentiment, can also impact the sales potential for life insurance agents. However, those who are highly motivated, skilled at sales and marketing, and have a solid network of contacts can be successful and earn a good income in the life insurance industry.

Which type of insurance agent makes the most money?

The type of insurance agent that makes the most money is a life insurance agent. They help families, businesses, employers, and other parties provide financial protection in the event of someone’s death. Agents selling life insurance can be either “captive” agents, representing only one company, or “non-captive” agents, representing multiple carriers. The job involves marketing to identify potential clients and providing them with quotes from various carriers. In terms of payment, life insurance agents receive anywhere from 30% to 90% of the premium paid in the first year. Renewal commissions are also paid and range from 3% to 10% per year. Agents are therefore well compensated for the work they do in helping clients protect their loved ones and businesses.

How to become an independent insurance agent?

Becoming an independent insurance agent requires similar steps as becoming a life insurance agent. The only difference is that independent agents are self-employed and work for themselves instead of a company or agency. After completing all the educational and state requirements, you will also need to purchase errors and omissions insurance, which is required in most states before an independent agent can sell insurance. Finally, you’ll need to market your services and build a network of clients.

Conclusion

To wrap it up, life insurance agents can make a good living. Anyone willing to take up the challenge of a career in this field will need to meet certain educational and state requirements, as well as hone their sales skills. Additionally, the life insurance industry is often highly competitive, making it important to develop a network of contacts and leads.

According to the Bureau of Labor Statistics, employment of insurance sales agents is expected to grow at a rate of 6 percent from 2021 to 2031, which is roughly on par with the overall industry average. An average of 52,700 job openings are projected to be created per year over the coming decade, largely due to workers transitioning to different occupations or leaving the workforce, such as due to retirement.

If you are interested in a career as a life insurance agent, read our other article to discover how many jobs are available in life insurance.